GST Exemption on Health Insurance 2026

Table of Contents

- Introduction to GST Exemption on Health Insurance

- Benefits of GST Exemption on Health Insurance

- Rules and Rates of GST Exemption on Health Insurance

- Impact of GST Exemption on Health Insurance Industry

- FAQs on GST Exemption on Health Insurance

Introduction to GST Exemption on Health Insurance

The Goods and Services Tax (GST) exemption on health insurance has been a significant development in the insurance industry. As of September 22, 2025, the GST rate on individual health insurance policies has been reduced to 0%, down from 18%. This exemption aims to increase the penetration of insurance products into the population and provide access to insurance cover for individuals. The GST exemption on health insurance applies to all individual health insurance policies, including family floater plans.

Benefits of GST Exemption on Health Insurance

The GST exemption on health insurance offers several benefits to policyholders. The most significant advantage is the reduction in premium payments. With the exemption of 18% GST on health premiums, the total premium payable by policyholders will be reduced, making insurance more accessible and affordable for individuals and families. Additionally, the exemption is expected to increase the demand for health insurance products, leading to a more competitive market and better services for policyholders.

Rules and Rates of GST Exemption on Health Insurance

The GST exemption on health insurance applies to all individual health insurance policies, including family floater plans. The exemption does not apply to group insurance policies, where the employer is paying the premium. In such cases, the GST rate of 18% will still be applicable. The GST exemption on health insurance is expected to be implemented from September 22, 2025, and will be applicable to all new and existing policies.

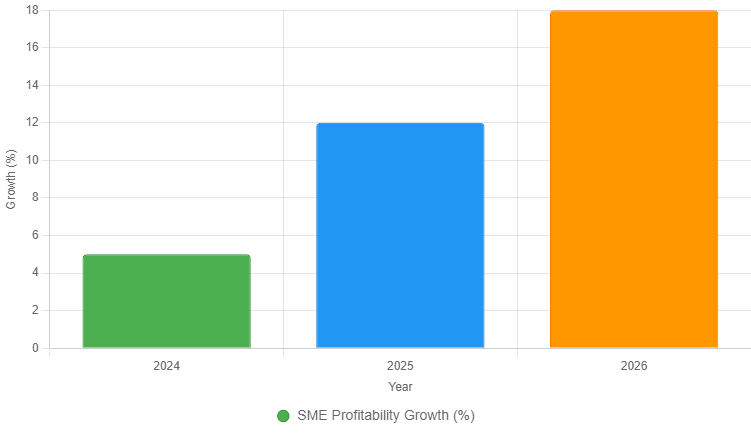

Impact of GST Exemption on Health Insurance Industry

The GST exemption on health insurance is expected to have a significant impact on the insurance industry. The exemption is expected to increase the demand for health insurance products, leading to a more competitive market and better services for policyholders. The exemption is also expected to increase the penetration of insurance products into the population, providing access to insurance cover for individuals and families. However, the exemption may also lead to a loss of revenue for the government, which may need to be compensated through other means.

Frequently Asked Questions

What is the GST exemption on health insurance?

The GST exemption on health insurance is the reduction of GST rate on individual health insurance policies to 0%, down from 18%. This exemption aims to increase the penetration of insurance products into the population and provide access to insurance cover for individuals and families.

Which insurance policies are covered under the GST exemption?

The GST exemption on health insurance applies to all individual health insurance policies, including family floater plans. The exemption does not apply to group insurance policies, where the employer is paying the premium.

How will the GST exemption on health insurance affect policyholders?

The GST exemption on health insurance will reduce the premium payments for policyholders. With the exemption of 18% GST on health premiums, the total premium payable by policyholders will be reduced, making insurance more accessible and affordable for individuals and families.

When will the GST exemption on health insurance be implemented?

The GST exemption on health insurance is expected to be implemented from September 22, 2025, and will be applicable to all new and existing policies.

Will the GST exemption on health insurance lead to a loss of revenue for the government?

Yes, the GST exemption on health insurance may lead to a loss of revenue for the government. The government may need to compensate for this loss through other means, such as increasing taxes on other goods and services.

How will the GST exemption on health insurance affect the insurance industry?

The GST exemption on health insurance is expected to increase the demand for health insurance products, leading to a more competitive market and better services for policyholders. The exemption is also expected to increase the penetration of insurance products into the population, providing access to insurance cover for individuals and families.