Category: Finance

Medical insurance is a vital safeguard, protecting you from soaring healthcare costs and ensuring access to quality care. It covers everything from routine check-ups to emergencies, offering financial security and peace of mind. With preventive care and family coverage options, it’s an essential investment for your health and future stability.

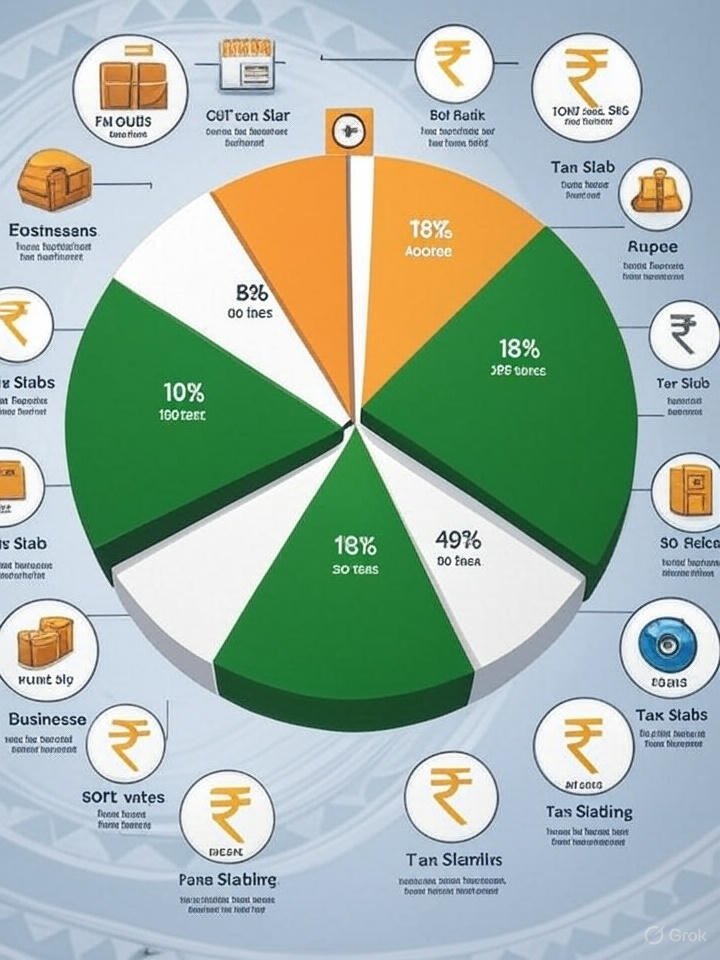

22 सितंबर 2025 से भारत में जीएसटी सुधार लागू होंगे, जिससे जीएसटी स्लैब को 5% और 18% में सरल किया गया है। रोजमर्रा की वस्तुएं जैसे दूध, साबुन, टीवी, छोटी कारें, और स्वास्थ्य सेवाएं सस्ती होंगी, जिससे मध्यम वर्ग और किसानों को राहत मिलेगी। वहीं, लग्जरी कारें, तंबाकू, और कुछ कोयला ग्रेड महंगे होंगे। ये बदलाव महंगाई कम करने और अर्थव्यवस्था को बढ़ावा देने के लिए हैं। विस्तृत जानकारी के लिए PIB प्रेस रिलीज देखें।

Explore the 2025 GST rule changes impacting India’s business class! From mandatory e-invoicing to simplified quarterly returns, learn how these reforms affect SMEs, entrepreneurs, and professionals. Discover benefits, challenges, and strategies to adapt, with FAQs and visuals to guide you. Stay compliant and thrive in India’s evolving tax landscape! Visit gst.gov.in for official updates.

Following the 56th GST Council meeting, India’s GST structure is being streamlined effective September 22, 2025, with a new three-tier slab system: 5% (essentials), 18% (standard goods), and 40% (luxury/sin goods). The 12% and 28% slabs are largely eliminated. Key changes include exemptions for life and health insurance, reduced rates on daily essentials like food, personal care, and agricultural machinery, and higher taxes on luxury goods and tobacco (implemented later). These reforms aim to lower prices, simplify compliance, and boost economic growth. Check the GST portal for detailed notifications.